Last week I went to an evening talk at Intuit, hearing from a collection of designers, technologists, and strategists working to make personal finance more engaging for laypeople.

The panel was moderated by Leslie Witt (Design director of Intuit Small Businesses.), and had 4 thoughtful speakers: Mike Tschudy (head of design, Mint.com), Ben Knelman (CEO of Juntos), John Won (Financial Health Program director Ideo.org), Evelyn Huang (VP of Capital One Innovation Labs).

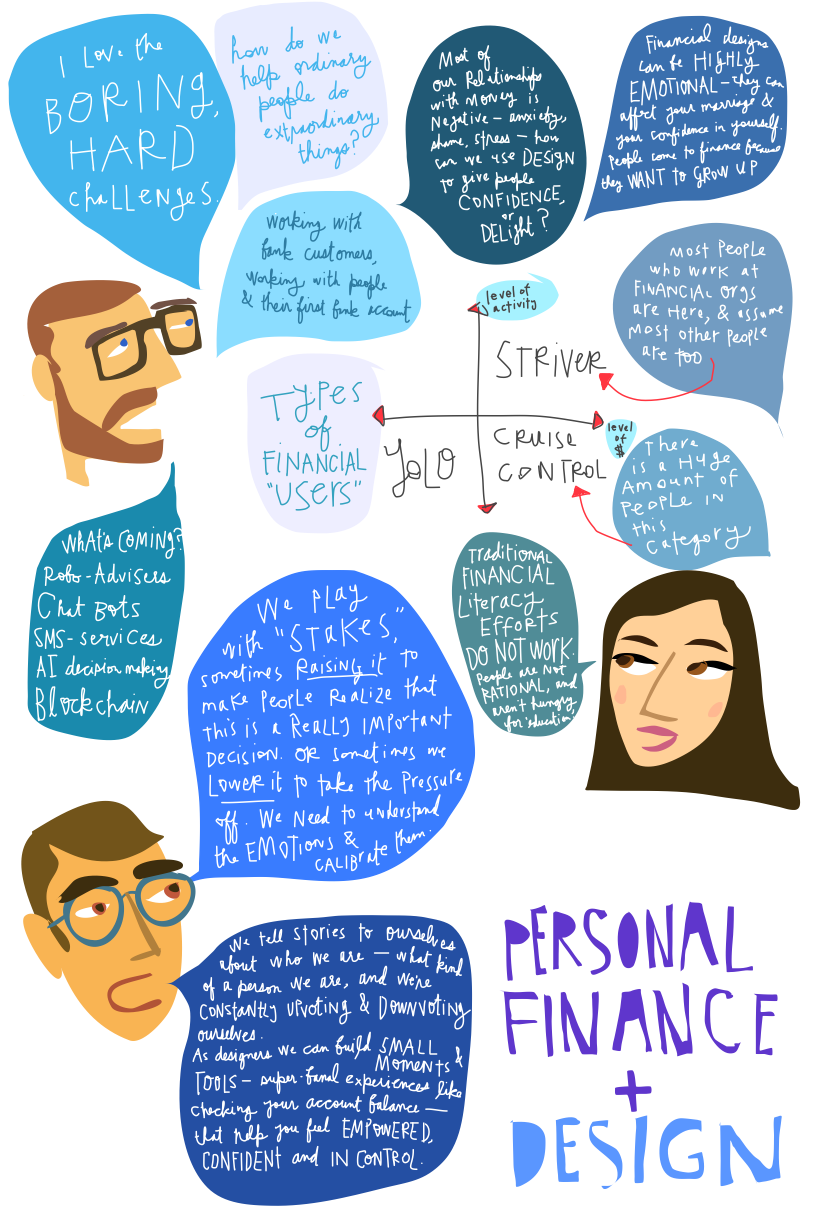

I sketched out some of the most interesting comments from the panel.

I’m particularly excited by the notion of the Power of the Banal Experience.

Meaning, that if we can give people the power to easily perform small-seeming transactions with a system (like the finance system, like the legal system, etc.), this can have an outsized effect on their sense of empowerment and their confidence to take charge of their activities within the system.

Like, if we give people the power to quickly, instantly check their bank account balances on their phone — this small balance-checking helps them tell a more positive, adult story to themselves about who they are, and how they relate to finances. As one of the panelists described, the mere act of seeing their own balance helps them to ‘upvote’ themselves, and tell themselves a more positive story to themselves about themselves: “I am an adult, I am in charge of my finances, I know how much money I have.”

This is in opposition to the usual stories people tell themselves about their finances:

“I don’t really know how much money I have.”

“I’m not good at money.”

“Finance isn’t for me, no one ever taught me about it.”

Even though almost everyone is anxious about money, and financial matters have a huge effect on their stress, family relationships, love-life, and day-to-day happiness, it’s remarkably hard for people to take a strong and sustained interest in their own personal finances.

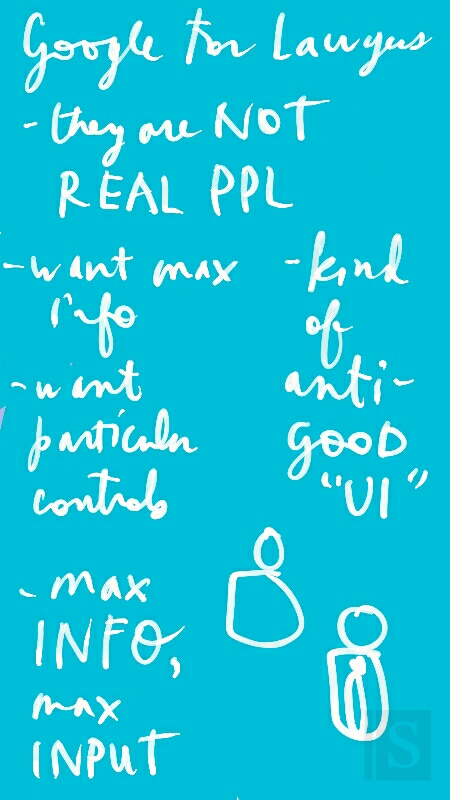

Designers are aiming to create new kinds of entry-points to the financial system, to make it easier to engage and in more positive ways. They’re trying to up-end typical financial literacy education, which assumes that people are totally rational and unemotional. This approach does not work. We need to be more creative — and more tuned into how people relate to the financial system, and what messages and tools resonate with them — to truly engage people in becoming smarter and activated in the financial system.

All of these lessons and initiatives can be pulled out from personal finance — they apply to how people relate to the court system, to government services, and to healthcare as well.

What are some of the new ways that we can expect to improve people’s engagement with these intimidating and obscure systems? The designers at the panelists pointed to technology avenues:

- More bots to allow for conversational back-and-forths to get tasks done and understand options

- More Blockchain-empowered automation and verification

- Robo-advisors that use expert system knowledge and the person’s personal preferences and data to make choices for them

- Mobile SMS communication that lets people take small actions and monitor their progress in the system through their phone

- Decision-making support from artificial intelligence and wisdom-of-the-crowds tools

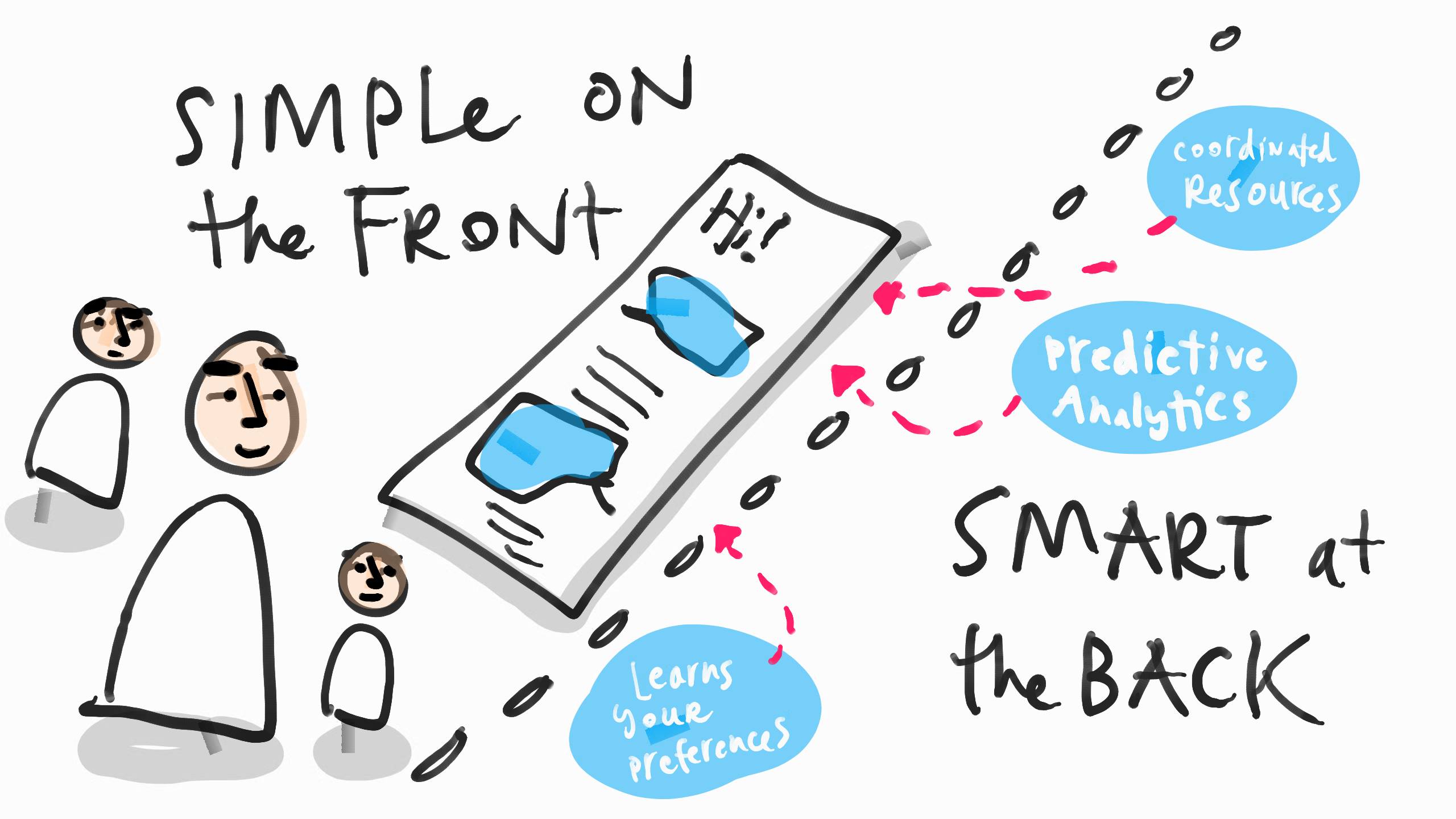

And I see a promising avenue, in addition, to be the development of tools that help people solve their problems across these artificial domains we’ve created — the same tool or platform that helps a person solve the financial, legal, medical, etc. dimensions. The designers need to be talking together about this coordinated, holistic type of solution — and the technologists need to be building interoperable apps that carry a person through these multiple systems.

(Cross-posted over at Medium.com as well)

1 Comment

Poly High School did offer seniors a year-long economics class that focused on personal finance for an entire semester. It was created and taught by Adler; he taught students about saving, investing, loans, paying taxes.